Introduction

Beginning investment in property abroad, is a critical step, promising unforgettable moments and large rewards financially

Bali, an island known for its breathtaking natural scenery, vibrant cultural understanding, and hospitable community is a preferred destination for those who desire more than just a spot to unwind. It calls for expatriates, digital nomads, and investors from every corner of the world that provide them with a different experience to integrate them into the diverse web of life. On the other hand, the cherished dream of possessing property in this heaven on earth carries its challenges — dealing with visa and tax regulations peculiar to foreign ownership. If you are thinking of Bali as your second home and investment haven, you should bear in mind that good legal knowledge is not only beneficial— it is essential. This excursion is meant to unmask the regulatory framework so that your transition into Balinese property ownership is as pleasant and fruitful as Balinese serene beaches.

The Attraction of Bali for Foreign Property Owners

Bali's charm is undeniable. The island's legacy, otherworldly landscapes, and one-of-a-kind living style are hailed by different global citizens as a haven of relaxation and adventure. The next picture of Bali is a market that is very dynamic and attractive for foreign investors because it provides great opportunities and a relaxed lifestyle that includes huge returns.

The idea of owning a Bali real estate sounds attractive but someone must prepare for the complexities of the Indonesian bureaucracy. Compliance with visas and taxes is one of the most important obligations to be followed as they depict the overall fulfillment and satisfaction of investment.

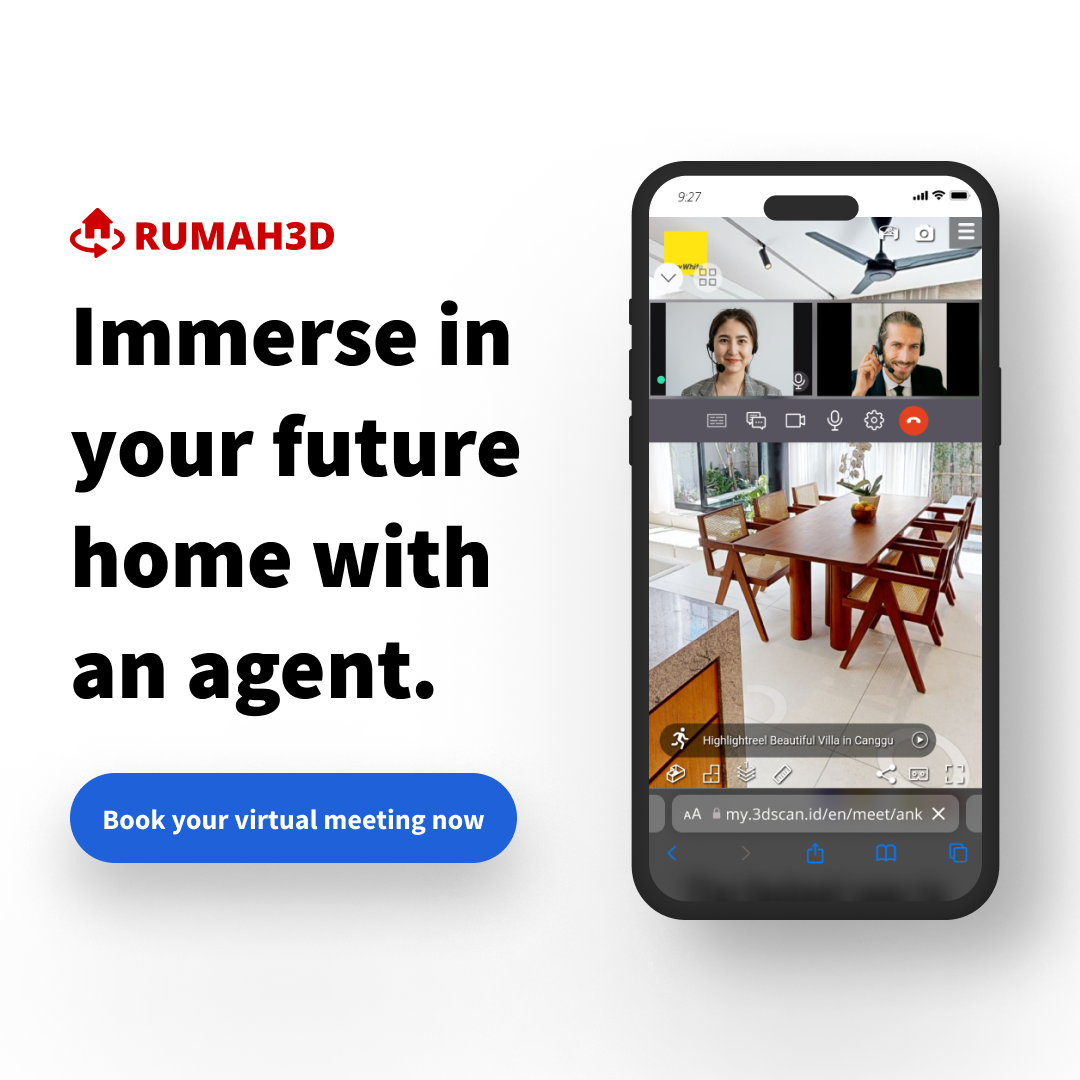

All agencies that are listing properties with Rumah3D are proven and respected businesses in Indonesia.

Understanding Visa Implications

A lot of foreign property owners are faced with the ordeals of the first step i.e. securing the right Visa. There are multiple visa options to choose from, which have their own set of conditions and advantages. Bali property investors must become familiar with the following types: Bali property investors must become familiar with the following types:

Social and Business Visa

The social and business visas offer a stay of 60 days which can be renewed, for a maximum of four days at a time. Each extension provides a stay of 30 days. This option is well-fitted for people who want long stays but without the tourist visa requirement.

Retirement Visas

The Retirement visa, which is also known as the "lanjut usia" visa, is the most preferred one for retirees and that is what they get for one year of stay. A person must be at least 55 years old and cannot be engaged in any employment opportunities.

Investor Visas (KITAS)

The residence KITAS visas are only issued to expats who plan to stay in Indonesia for long-term periods. The main objective of this product is to list it as the favored cruise for the people who play an active role in managing Bali business and property.

The process of visa immigration is governed by the administration of the application, a process that may involve documentation that relates to the property file and may require verification to state that the applicant can financially support himself during the stay. A robust understanding of these processes is vital to avoid delays and complications.

Taxation of the Property Ownership by Foreigners

Buying land abroad is a new story in the financial discipline. Navigating Bali's tax landscape can initially appear daunting to newcomers. However, the cornerstone of managing this complexity lies in understanding the specific obligations tied to property ownership, such as:

Property Acquisition Tax (BPHTB)

This levy is paid when you acquire a property in Bali. The amount varies based on the nature of the transaction, the value of the property, and also whether the buyer is an overseas or a domestic Indonesian.

Property Taxes (PBB)

The Land Rate Tax and the Building Rate Tax are continuous taxes based on the appraisal value of the land with any construction or upgrades. Foreigners ought to be aware of their tax obligations yearly.

Revenue from Income Taxes and also Capital Gains Taxes

That income from both the sales and rentals of property is subject to tax. Knowing the rates and also applicable exemptions is a very key element of effecting property-related activities efficiently and properly.

There may be many financial issues like exchange rates when repatriating income, and international tax agreements might also affect the Bali investment for an individual.

Compliance Advice For Foreign Owners of the Property

To ensure a smooth experience with visa and tax compliance, consider the following tips:

Stay Informed and Organized

Following up with regulatory changes and also using a meticulous approach to record keeping are very key topics to keep in mind. Consider all possible ways of fulfilling the immigration requirements. Focus on first obtaining a visa and documents that prove the status of residency and property ownership.

Engage Early and Proactively

Undertake the compliance process promptly so that you can avoid the last-minute squeezes, which in turn can be caused by errors and additional stress. Proactive engagement includes seeking the advice of estate planning attorneys as well as tax professionals with expertise in matters of foreign property.

Exercise Patience and Flexibility

Where Bali, Indonesia has several distinctive processes in its administrative systems, you may find those are very different from the ones in your home country. Keep in mind the longer processing timelines and consider being flexible in your approach.

Local regulations and legal considerations

Bali has strict local regulations and most of all regarding foreign property ownership. Being aware of these regulations helps resolve expensive legal problems and property conflicts. It is also essential to notice whether there are any local community ordinances or traditional laws that apply to property usage and developments.

Using a case study approach may be insightful because it shows in real life the challenges and solutions the foreign property owners on the island adopted. The experience of others can guide you to avoid legal pitfalls when you are doing so with greater confidence.

Making the Most of Opportunities While Keeping Risks at Bay

Strategic planning can help to prevent you, as a foreign owner, of a property in Bali from the risks and full advantages of visa and tax regulations. This involves:

Leveraging Visa Benefits

Getting to know your visa conditions can sometimes result in an extension of your stay, fast-tracking your residency, or business plans that match your property investment.

Tax Planning and Optimization

Through tax planning, you can decide on the right structure of your investments for the best tax outcomes. Strategies can be either to set up local businesses or to use the tax treaties between Indonesia and your home country.

Balancing Act

Visa and tax regulations are governed by a process of balancing compliance and the quest for financial goals. Such a long-term strategy that tackles both aspects will not only promote compliance but also widen the financial value of your property.

Professional Help and Expert Guiding

Consulting professionals and experts in visa compliance and taxation are essential. A variety of reputable legal and financial consultants with a thorough understanding of the Bali property market can give you specialized solutions to fulfill your obligations and safeguard your rights.

The success stories of those who have sought expert assistance are a testament to the value of this guidance. Professionals can not only facilitate the compliance process but also provide peace of mind that your investment is in reputable, knowledgeable hands. Rumah3D is proud to have partnered with Seven Stones Indonesia, a reputable company providing progressive, smart and collaborative investment solutions, including private and commercial property services, investment and business advisory services, financial planning, legal assistance, preliminary feasibility studies, market entry services and consultations.

Conclusion

It is a boost to the global portfolio, which enables one to become a landlord for life. This requires having a grasp of and being able to properly apply for visa and tax regulations of your host country. Through proactively preparing yourself by educating, getting in touch with experts, and staying on top of all the legal and financial news, you can experience a compliant and rewarding ownership in Bali.

These adventures can become a success for expatriates and investors as the secret is to go with confidence and preparations to achieve a smooth and profitable investment in Bali. The setting sun and the island's shores merge into a moment not only the end of a day but also a life that has been realized in its full totality.